Table of Contents

Next-Gen GST Reforms

The 56th GST council, chaired by Finance Minister – Nirmala Sitharaman, introduced some crucial Goods and Services (GST) reforms on 3rd September 2025. These tax revisions are expected to come as a relief for the Indian consumer, as it will lower cost of living and ease compliance for businesses.

The latest GST overhaul is one of the biggest tax reforms in the last 8 years, and possibly comes in the light of the new tariff policy imposed by the US. This primarily reduces the tax slabs into two categories, i.e. 5% and 18%, replacing the 4 slabs ranging from 5% to 28%.

Of the many tax cuts that have been introduced, the GST revision on life and individual health insurance is among the most crucial reforms as it brings the GST down from 18% to 0%. This change also aligns with the government’s long-term vision of “Insurance for All by 2047”, as the premiums are expected to get cheaper and therefore more accessible to the masses.

What’s Changed?

Before the tax revision, policyholders were required to pay 18% GST on the policy premiums for individual life and health insurance. For example, an annual health insurance policy whose premium cost is Rs. 20,000 would cost about Rs. 24,000 after the 18% GST is added. This added cost discouraged many users from purchasing insurance, specially in lower- and middle-income households.

However, with the new tax cuts, all individual life insurance policies – including term life, Unit Linked Insurance Plan (ULIPs), and endowment plans, and all individual health insurance policies, such as family floater and senior citizen coverage, are exempt from GST3. Furthermore, the exemption also extends to reinsurance, ensuring that the overall cost structure becomes cleaner and more consumer friendly.

Why It Matters?

This reform comes not just as a financial adjustment but also as a strategic imperative with far-reaching implications…

- Affordability Boost: The removal of GST from the retail life and health insurance segment will significantly bring down the premium costs, making insurance more accessible and affordable for the unprotected masses.

- Increased Adoption: This reform also aligns with the government’s vision of “Insurance for All by 2047”, as it is expected to encourage more people to opt for coverage. In FY24, India’s insurance penetration had declined from 3.7% to 2.8%, which left a large population unprotected and underinsured.

- Industry Alignment: This reform will also reduce litigation through simplified compliance, increase consumption, and bring formalisation in this segment, which aligns with the broader economic goals.

- Combating Medical Inflation: India has the highest medical inflation at 14% among the Asian countries, which has exponentially increased the cost of medical care putting many families in a debt cycle due to the high out-of-pocket expenses. The reform will ease the burden on families planning for long-term health security and the ones that are dealing with chronic illnesses.

Impact on the Insurance Segment

The GST reforms on health and life insurance policies will mark a pivotal shift for the entire insurance ecosystem and will reshape both consumer behavior and business strategy. Here are some key industry-wide changes that can be expected:

1. Shift in Pricing and Product Strategy

The loss of input tax credit (which initially helped businesses reduce their tax liability) will likely be factored into the pricing of insurance policies and might create short-term margin pressure. However, insurers will likely recalibrate their pricing models to absorb these changes rather than pass them on, as it will open doors for competitive pricing, bundled offerings, and simplified products tailored for new buyers.

2. Operational Adjustments

The removal of GST on reinsurance ensures benefit flows through the entire insurance value chain and streamlines the backend operations. This means that insurers no longer need to deal with complex and cascading tax structures. This will also reduce compliance costs and improve operational efficiency substantially.

3. Investor Sentiment and Market Dynamics

The reform has injected fresh optimism into the insurance sector. While stock prices showed mixed reactions initially, long-term investor sentiment remains bullish. Companies with strong retail portfolios are expected to benefit most, as the long-term outlook is primarily optimistic and the increased demand will most likely offset transitional costs.

Charting The Way Forward

The GST exemption on life and health insurance is more than a GST reform. It’s a massive policy signal, reflecting a shift toward inclusive growth, financial resilience, and a healthier India. As the reform takes effect, stakeholders across the board, from insurers to consumers, will need to adapt, innovate, and collaborate to maximise its potential.

India’s journey toward universal insurance coverage just got a powerful push. And for millions of families, that could mean the difference between vulnerability and security.

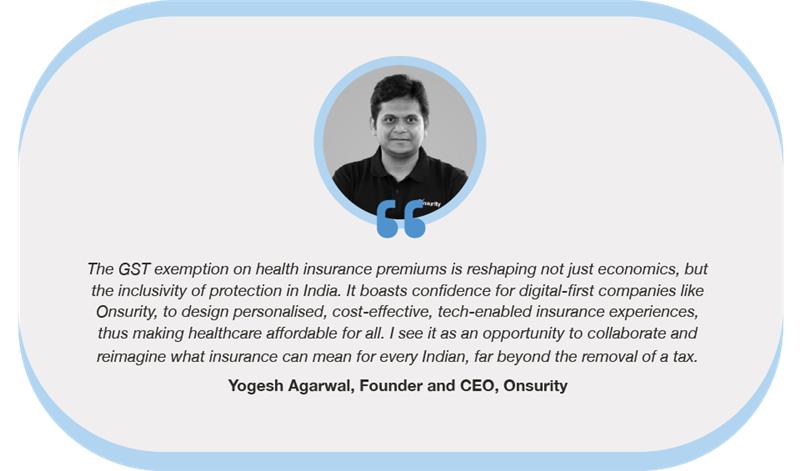

The Onsurity Take

Onsurity is one of India’s well-known employee health and wellness benefits providers for startups, small, and medium businesses. Founded with the core vision to make quality healthcare accessible to all, Onsurity benefits have always found a seamless alignment with economic policies and regulatory framework in this segment.

Onsurity is committed to passing on the benefits directly to our members and accelerating our mission of inclusive, affordable insurance for all.